Consider the balance in your mobile wallet (say Rs. 10,000). Is there any difference between each of these rupees? No, there isn’t. So we can say that this digital money is “fungible” – every rupee is exactly the same as another rupee.

Is every 500-rupee note identical in value? Most people would say yes. But it’s not! An older 500-rupee note is worth zero – remember demonetisation? So, we can say that physical currency notes are “non-fungible”.

To understand what a non-fungible token (NFT) is, let’s take an example. Sanya is an artist who creates a bunch of manga ink on paper drawings. She sells them online as well as at a physical art gallery. But she can sell each drawing only once because, hey, it’s a physical drawing.

She can also create multiple reprints and sell them. Each reprint is identical. So if there are very few official reprints, the price can be high. If there are many reprints the price will be very low. That’s the law of scarcity at work. We are usually ready to pay more for things that are rare.

But how would a buyer know how many reprints are in existence?

That’s where NFTs come in. Sanya can release digital copies of her drawings on the blockchain in the form of non-fungible cryptocurrency. Because of the blockchain’s inherent transparency, any buyer can see how many digital copies are actually in circulation. And anyone can see who owns how many digital copies.

Wait, there’s more. When you “buy” a digital version of a manga from an artist you only get the right to use it for personal viewing. That’s because the artist holds the copyright over the manga. But in an NFT, the artist can grant you special licenses such as the right to print the manga on t-shirts, and make money by selling those t-shirts. Now, isn’t that cool?

1. What I love about NFTs

As an author and content creator, I love NFTs. When you buy a book, the only thing you can do is read it. With an NFT, the author can give you the right to translate it into another language and make money by selling the translated version. NFTs make it easy for creators to monetise their content.

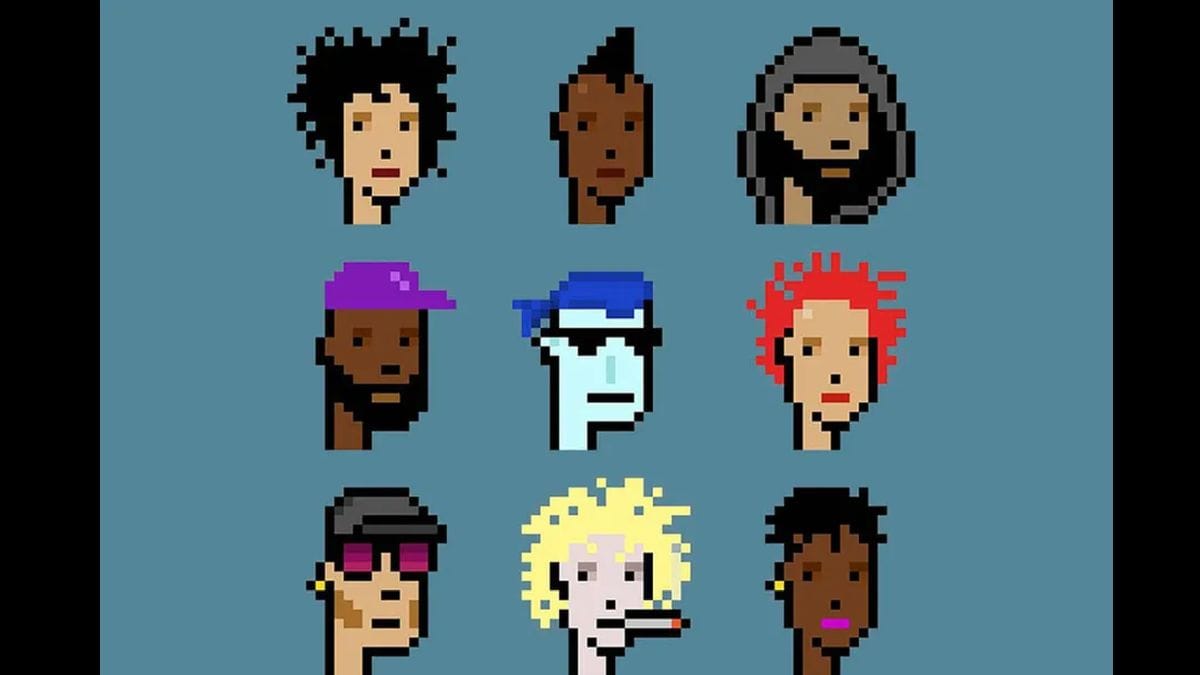

NFTs bring true decentralisation into the crypto market because anyone can issue them. NFTs can be of many types, including:

- Art

- Collectibles (postage stamps, trading cards, sneakers)

- Domain names

- Financial instruments

- Intellectual Property assets like trademarks, patents, designs, etc.

- Music

- Photos

- Talent

- Tokenised assets (cars, land, oil)

- Videos of iconic events

- Virtual game items (avatars, skins, weapons, etc.)

2. What I hate about NFTs

I hate most of the NFTs out there today because they give the buyer nothing except a piece of digital art. What’s the point of “buying” a computer-generated digital image? Hundreds of sites let you download millions of stock images and graphics for free.

Paying for a digital picture of a superstar makes zero sense to me. If I was legally allowed to use that pic for promoting my business, then that would make sense. But that’s not how things are as of now.

3. What I fear about NFTs

I fear that many of the current super-expensive NFTs are going to go bust when people think beyond the hype. A lot of people will lose a ton of money and that may give NFTs a bad name!

Rohas Nagpal is the author of the Future Money Playbook and Chief Blockchain Architect at the Wrapped Asset Project. He is also an amateur boxer and a retired hacker. You can follow him on LinkedIn.

Interested in cryptocurrency? We discuss all things crypto with WazirX CEO Nischal Shetty and WeekendInvesting founder Alok Jain on Orbital, the Gadgets 360 podcast. Orbital is available on Apple Podcasts, Google Podcasts, Spotify, Amazon Music and wherever you get your podcasts.

Cryptocurrency is an unregulated digital currency, not a legal tender and subject to market risks. The information provided in the article is not intended to be and does not constitute financial advice, trading advice or any other advice or recommendation of any sort offered or endorsed by NDTV. NDTV shall not be responsible for any loss arising from any investment based on any perceived recommendation, forecast or any other information contained in the article.